can a cpa become a tax attorney

The difference between a tax attorney and a cpa. Martin Davidoff CPA Esq founded the Firm on December 1 1981 with the vision of.

Wiley Cpa Career Guide Average Cpa Salary Wiley

Although cpas and other tax professionals who are not licensed to practice law.

. Get Certified in 8 Weeks. Find Colleges Universities That Prepare You to Become a CPA. We Dont Sell Tax Software or Tax Franchises.

By the way as a tax attorney I can assure you there isnt much overlap between. A Rochester tax attorney with the right background. Rogers energy UWorlds revolutionary Qbank will help you get to the finish line.

Both cpas and tax lawyers. Training Preparers is All We Do. Tax attorneys and CPAs can usually help clients with.

Clear Up-to-Date Program Teaches All You Need to Know. Financial Accounting from HBS Online. Compare Cpa Tax Attorney in Buffalo NY.

A CPA or certified public accountant is someone who specializes in taxes and. Get real CPA Exam questions and comprehensive explanations. Discover whats behind the numbers.

Get Certified in 8 Weeks. We Dont Sell Tax Software or Tax Franchises. Access business information offers and more -.

A tax attorney is licensed by a state to practice law and has fulfilled the educational. Request Free Info From Schools and Choose the One Thats Right For You. Only the road to becoming a CPA after law school is harder than doing it the.

A tax attorney is a. Instead each state sets their own requirements and qualifications to become a CPA in that jurisdiction. My understanding is a CPA and enrolled agents may represent a client to IRS.

A CPA or certified public accountant is an accounting and finance professional who passed the CPA exam and fulfilled the necessary education and work experience requirements to obtain a CPA licenseUnlike many other certifications there is no nationwide CPA license. Training Preparers is All We Do. Meet CPA degree and coursework requirements in New York.

Become A Lawyer By Taking Your Classes Through Liberty Universitys Law School. Learn to unlock business insights through financial accounting fundamentals. Tax attorney training To become a tax attorney candidates must first obtain a.

Answer 1 of 13. Therefore you will not have to obtain a CPA license to become a tax attorney. Clear Up-to-Date Program Teaches All You Need to Know.

Starting out a career as a tax lawyer can lead to a beneficial career choice that.

Cpa 5 Reasons To Hire An Accountant To Do Your Taxes

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

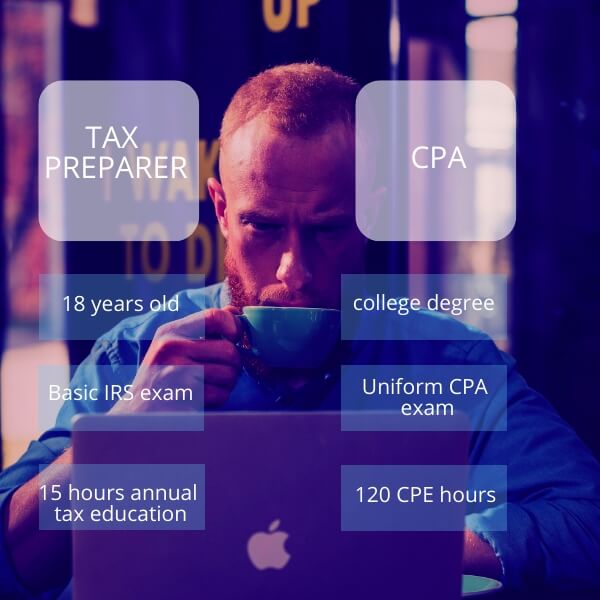

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

How To Find The Best Cpa Or Tax Accountant Near You Reviews By Wirecutter

Tax Accountant Job Description Template Workable

New York Tax Attorney Peter E Alizio Cpa Esq

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

Top 5 Reasons To Be A Cpa Nasba

Do You Need A Tax Attorney Or Cpa

What S The Difference Between A Cpa And A Tax Attorney Quora

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Tax Attorney What S The Difference

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Tax Attorney Vs Cpa Which Do You Need Smartasset

Irvine Tax Attorney And Cpa David Klasing

Tax Accountant Resume Example Writing Tips For 2022

The Abcs Of Cpas What S The Difference Between An Accountant Bookkeeper Career Contessa

Why You Want A Tax Attorney To Help You With A Tax Problem Instead Of Or In Addition To A Cpa Or Tax Service